Transaction highlights

Incitec Pivot Limited (ASX: IPL) has reached an agreement for the sale of its ammonia manufacturing facility located in Waggaman, Louisiana, USA (Waggaman) to CF Industries Holdings, Inc. (CF) for a total value of US$1.675bn (A$2.50bn)1.

IPL has also secured a 25-year ammonia supply agreement with CF for up to 200,000 short tonnes of ammonia per annum to support the Dyno Nobel Americas (DNA) explosives business. The ammonia supply agreement secures ammonia at producer cost2 for the DNA business. The value allocated to the ammonia supply agreement is approximately US$425m (A$634m) which will be offset from the cash proceeds of the sale agreement for Waggaman3.

The divestment of Waggaman remains subject to US anti-trust regulatory clearance and the completion of other customary closing conditions.

Under the terms of the sale agreement, these conditions must be satisfied within 24 months of execution of the agreement.

Strategic rationale

The Waggaman strategic review was undertaken with our previously articulated objective of monetizing the value of the excess ammonia production from the facility while retaining the strategic value of the Waggaman site to the competitiveness of the DNA explosives business.

IPL has undertaken a robust competitive sales process to seek full value delivery for the excess commodity exposure and to secure a long-term cost competitive ammonia supply for the DNA business with a trusted and proven strategic offtake partner.

Long-term ammonia offtake agreement

Consistent with the objective described above, IPL has entered into a 25-year ammonia supply agreement with CF (initial 15-year term with the option to extend by two further five year periods at IPL’s discretion) for the supply of up to 200,000 short tonnes per annum of ammonia at producer cost4 to support the long-term cost competitiveness and sustainability of the DNA business.

The long term ammonia supply agreement provides:

• a basis to monetise DNA’s current excess ammonia exposure whilst maintaining the strategic value of cost competitive ammonia supply into our DNA explosives business;

• a platform to transform the quality of earnings base anchored on a highly competitive cost position; and

• the flexibility to pursue debottlenecking opportunities at DNA’s Louisiana, Missouri plant to support the execution of our value based growth objectives.

The ammonia supply agreement is subject to successful closing of the Waggaman divestment, as well as other customary terms and conditions.

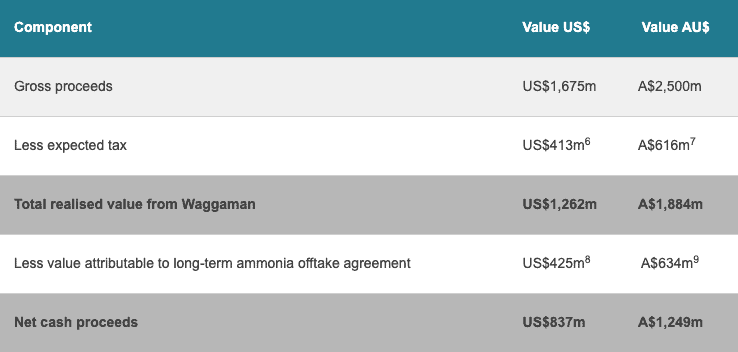

Summary of value for Waggaman divestment

The key value components of the proposed transaction are set out below5.

The net cash proceeds from the sale are intended to be allocated in line with IPL’s previously disclosed Capital Allocation Framework.

IPL engaged J.P. Morgan Securities LLC as financial advisor and Latham & Watkins LLP as its legal advisor on the transaction.

IPL’s Managing Director and CEO, Jeanne Johns said:

“Our announcement today represents a pivotal step in the execution of our strategy to enhance the focus of our businesses on the technical engineering and service needs of our explosives customers. We are also delighted to be partnering with CF Industries, a world-class producer of ammonia with an excellent manufacturing and safety track record. We are looking forward to this journey as we seek to deliver long-term sustainable value creation for our shareholders and stakeholders.”

Investor briefing

IPL will hold an investor conference call/audio webcast at 10.00am tomorrow, Tuesday 21 March 2023 (AEDT).

The link to register for the audio webcast is here.

1Based on an AUD:USD exchange rate of 0.67, and including the value allocated to the ammonia supply agreement.

2This means that the pricing under the offtake agreement is linked to gas based pricing at a level commensurate with Waggaman’s cost of production.

3Accordingly, it is expected that cash proceeds received on completion of the sale of Waggaman will be approximately US$1.250bn (AUD$1.866bn).

4See note 2

5Value components assume completion of the sale agreement in accordance with its terms and USD$/AUD$ of 0.67.

6Potential tax liability has been calculated on upfront consideration only.

7See note 6.

8This asset will be recognised as an intangible asset and its value in use will be assessed at each period end. The amount reflected in the table is indicative and will be reassessed at transaction close, taking into account forward looking ammonia prices at the time.

9See note 2.

For more information:

Investors

Geoff McMurray

General Manager Investor Relations

Tel: +61 3 8695 4553

Mobile: +61 418 312 773

geoff.mcmurray@incitecpivot.com.au

Media

Matthew Flugge

Group Vice President Corporate Affairs

Tel: +61 3 8695 4617

Mobile: +61 409 705 176

matthew.flugge@incitecpivot.com.au

via Incite Pivot Press Release