This article is brought to you by: DFI Piling, leaders in helical piles

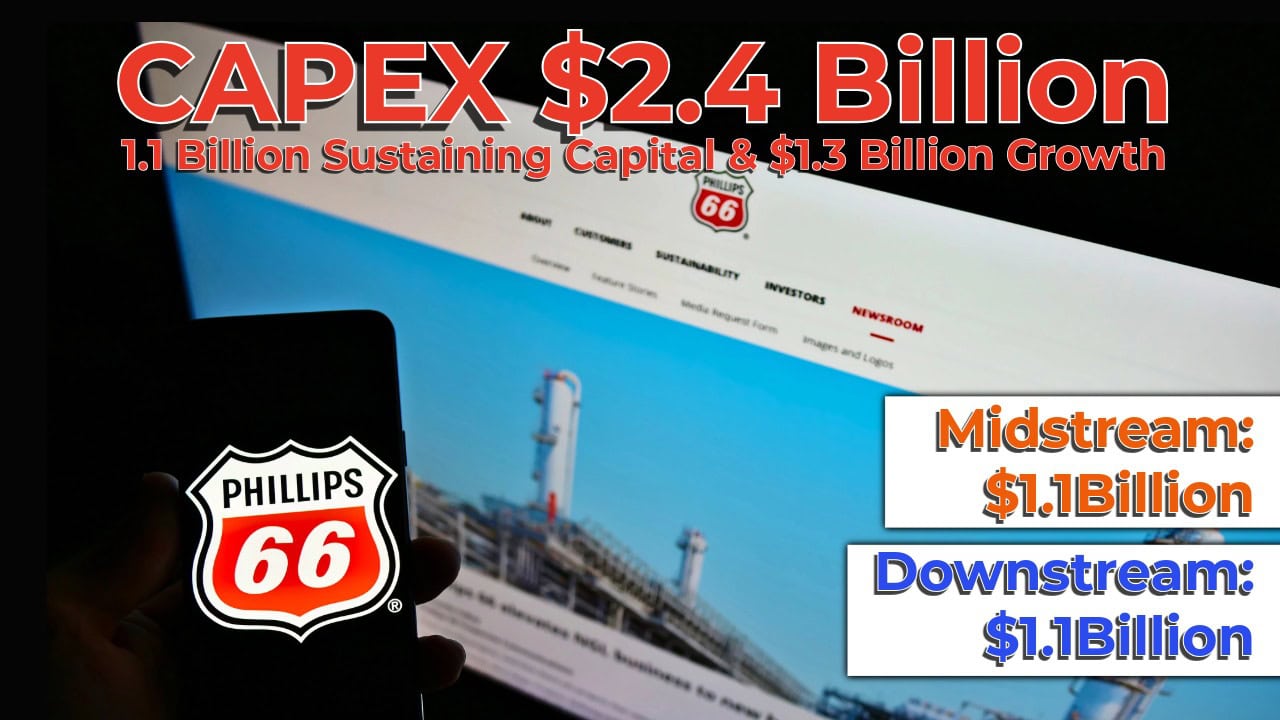

HOUSTON, Dec. 15, 2025 – Phillips 66 (NYSE: PSX) today announced its 2026 capital budget of $2.4 billion, including $1.1 billion for sustaining capital and $1.3 billion for growth capital.

“The 2026 capital budget reflects our ongoing commitment to capital discipline and maximizing shareholder returns. We are investing growth capital in our NGL value chain and high-return Refining projects, while also investing sustaining capital to support safe and reliable operations,” said Mark Lashier, chairman and CEO of Phillips 66.

Lashier added, “With the consolidation of WRB Refining, we incorporated approximately $200 million of sustaining capital and $100 million of growth capital into the budget.”

Midstream

In Midstream, the capital budget of $1.1 billion includes $400 million for sustaining projects and $700 million for growth projects. The projects organically advance the company’s integrated NGL wellhead-to-market strategy by increasing gas processing, pipeline and fractionation capacity in key basins. The growth capital spend includes:

- Iron Mesa gas processing plant – a 300 MMCFD facility in the Permian Basin and the company’s largest in the region. The plant is expected to start up in the first quarter of 2027.

- Coastal Bend NGL pipeline expansion – increases capacity from 225 MBD to 350 MBD, enhancing connectivity between production in the Permian and Eagle Ford basins to fractionators in Corpus Christi and Sweeny. Expected completion in the fourth quarter of 2026.

- Proposed Corpus Christi fractionator – adds 100 MBD of NGL fractionation capacity and increases bidirectional access for Y-grade and purity products between Corpus Christi, Sweeny and Mont Belvieu. Final investment decision is anticipated in early 2026, with completion expected in 2028.

Refining

In Refining, Phillips 66 plans to invest approximately $1.1 billion, including $590 million for sustaining capital and $520 million for growth projects. The growth capital spend includes:

- Humber gasoline quality improvement project – a multiyear investment enabling production of higher-quality gasoline and greater access to higher-value global markets. Startup is targeted for the second quarter of 2027.

- More than 100 low-capital, high-return projects focused on crude flexibility, feedstock optimization and clean product yield improvements.

2026 Capital Budget Summary

| Millions of Dollars | Sustaining Capital | Growth Capital | Total Capital Budget |

|---|---|---|---|

| Midstream* | $400 | $700 | $1,100 |

| Chemicals | – | – | – |

| Refining* | $590 | $520 | $1,110 |

| Marketing and Specialties | $30 | $50 | $80 |

| Renewable Fuels | $10 | $30 | $40 |

| Corporate and Other | $40 | $0 | $40 |

| Phillips 66 Consolidated Capital Budget | $1,070 | $1,300 | $2,370 |

*Excludes non-cash finance leases of $10 million in Refining and $40 million in Midstream.

Phillips 66’s proportionate share of capital spending by its joint venture, Chevron Phillips Chemical Company LLC (CPChem), is expected to total $680 million and be self-funded. This includes $200 million for sustaining capital and $480 million for growth projects. CPChem’s growth capital will continue to fund the construction of world-scale petrochemical facilities on the U.S. Gulf Coast and in Ras Laffan, Qatar. The facilities are expected to start up in 2026 and early 2027, respectively.

About Phillips 66

Phillips 66 (NYSE: PSX) is a leading integrated downstream energy provider that manufactures, transports and markets products that drive the global economy. The company’s portfolio includes Midstream, Chemicals, Refining, Marketing and Specialties, and Renewable Fuels businesses. Headquartered in Houston, Texas, Phillips 66 has employees around the globe who are committed to safely and reliably providing energy and improving lives while pursuing a lower-carbon future. For more information, visit phillips66.com or follow @Phillips66Co on LinkedIn.

Cautionary Statement

This news release contains forward-looking statements within the meaning of the federal securities laws relating to Phillips 66’s operations, strategy and performance. These statements are based on management’s expectations, estimates and projections as of the date they are made and involve risks and uncertainties that may cause actual results to differ materially. Factors that could cause differences include changes in commodity prices, regulations, permitting, litigation, capital availability, operational risks, geopolitical events, climate-related regulations and other factors detailed in Phillips 66’s filings with the Securities and Exchange Commission. Phillips 66 undertakes no obligation to update forward-looking statements.

Use of Non-GAAP Financial Information

The disaggregation of capital spending between sustaining and growth is not a distinction recognized under U.S. generally accepted accounting principles. The company provides this information to demonstrate management’s return expectations.

Contacts

Investor Relations:

investorrelations@p66.com

Media Relations:

phillips66media@p66.com